Quarterly Updates

Download:

Share:

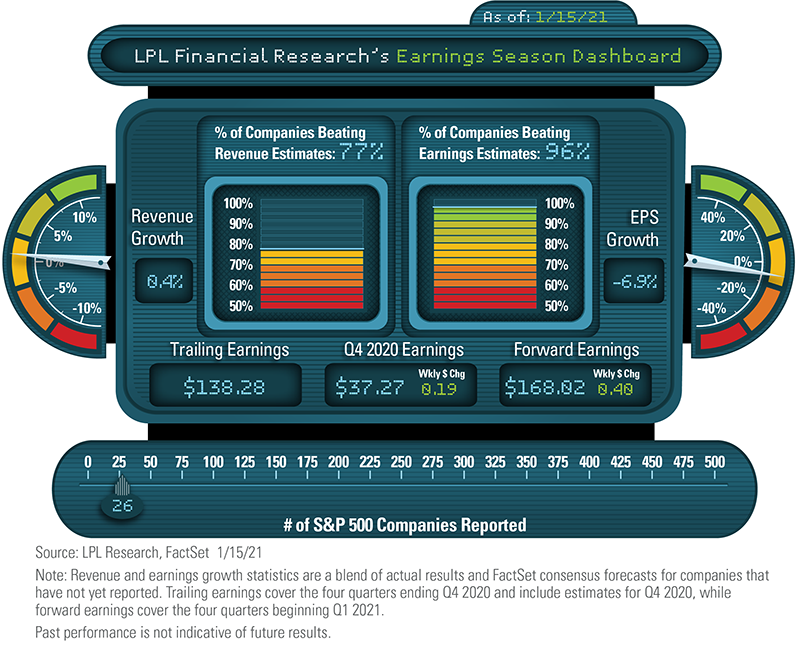

Source: LPL Financial Research, FactSet 1/15/2021

Important Disclosures:

Note: Revenue and earnings growth statistics are a blend of actual results and FactSet consensus forecasts for companies that have not yet reported. Trailing earnings cover the four quarters ending Q4 2020 and include estimates for Q4 2020, while forward earnings cover the four quarters beginning Q1 2021.

Any revenue forecasts presented are based on FactSet consensus. Any earnings forecasts are based on FactSet consensus, plus the long-term historical average for upside to estimates of 3%.

Past performance is not indicative of future results.

The economic forecasts set forth may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly.

Tracking #1-05101033

LPL Financial Research Q4 2020 Earnings Season Dashboard

- Earnings season is off to a very strong start relative to expectations. Only about 5% of S&P 500 companies have reported results, but 96% have beaten estimates.

- Forward 12 months’ estimates have already increased by 0.5% since January 1, 2021. Stability of estimates is key to enabling stocks to grow into lofty valuations.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and brokerdealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value